Last year, I was invited to speak on a panel at a global bank’s conference. Someone from the audience asked me if I believed that venture capital and technology startups could contribute to the achievement of the UNDP Sustainable Development Goals, also known as the Global Goals. The Global Goals were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030, all people enjoy peace and prosperity. I thought the answer was quite obvious, but perhaps the question wouldn’t have been asked if it was.

That got us at Wavemaker Partners thinking: we, venture capitalists, and our portfolio companies often say that we want to change the world. It’s part of the romanticism and optimism that fuels our industry. But do we truly mean it or is it just bravado?

If we say we do, the next question becomes: how do we show we truly mean it?

Let’s take a critical area like the climate. Very few places in the world will be as heavily impacted by climate change as our focus region, Southeast Asia. According to the Intergovernmental Panel on Climate Change (IPCC), we can only emit 500 gigatons of total carbon dioxide—known as the carbon budget—for a 50% chance of limiting global warming to 1.5 degrees Celsius above pre-industrial levels—the temperature threshold set by the Paris climate agreement. Given the average amount of carbon that the world produces every year, experts say we only have 10 years left until we exhaust that carbon budget. If we do not significantly reduce our carbon emissions, three of Southeast Asia’s biggest cities—Jakarta, Bangkok, and Ho Chi Minh—could be underwater by 2050. To put that into perspective, more than 30 million people living in these cities could be affected.

A report by Bain & Company, Microsoft, and Singapore’s Temasek Holdings says US$2 trillion in sustainable infrastructure is needed over the next decade to bring down Southeast Asia’s emissions substantially. That’s a huge gap. And where there’s a huge gap, there’s a huge opportunity.

Technology companies arguably have the best chance of bridging that gap through highly disruptive solutions that can be adopted at scale. But building infrastructure will take time. As we work on it as an industry, we at the firm asked ourselves: how could we purposely contribute to the Global Goals right here and now?

It’s a big question that, if we weren’t careful, would have led to ‘analysis paralysis’. We decided to take small steps toward sustainability. Believing that small steps—collectively—could have lasting effects, we launched ‘Green Wave’.

Going carbon neutral

Green Wave is an internal initiative to help Wavemaker and our community become more sustainability-focused across what is known as the triple bottom line or three Ps: people, planet, and profit.

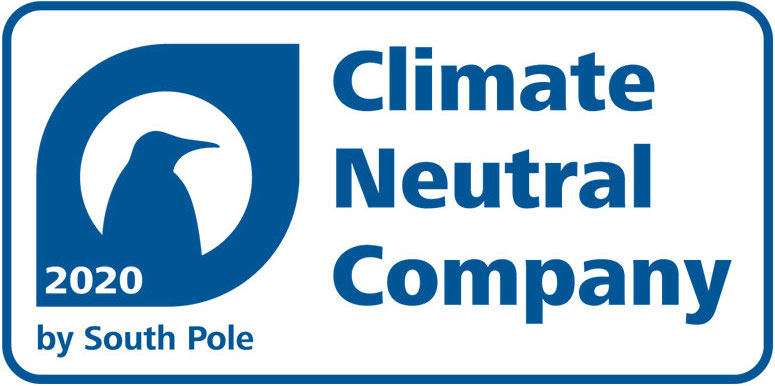

The first step we took under Green Wave was to partner with South Pole, a leading provider of global climate solutions, to measure and address our climate impact. We’re happy to report that we’re now a ‘Climate Neutral Company’, having earned the stamp early 2021.

South Pole measured our greenhouse gas emissions, which were predominantly from business travel, purchased goods and services, and electricity consumption. We then compensated for these emissions by financing climate action.

Out of a whole range of projects, we decided to purchase carbon credits from the Vietstar Sustainable Waste Treatment in Vietnam, which addresses the environmental impact of municipal landfills. By recycling and turning organic waste into compost, this sustainable fertiliser project creates jobs for the local community and supports farmers.

We didn’t stop there.

Portfolio mapping

We then mapped our portfolio companies against the Global Goals.

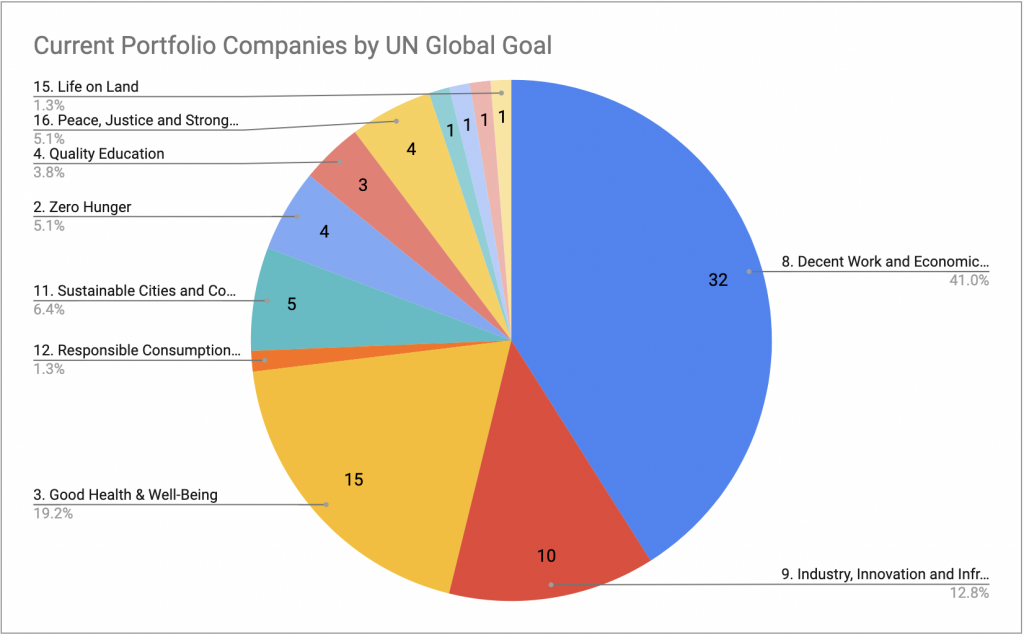

We were pleased to find that about 70% of our active portfolio companies contributed to at least one of the Global Goals. This was helped by our enterprise and deep tech focus.

We genuinely feel that many of our portfolio companies contributed to Goal #8 (decent work and economic growth) and Goal #9 (industry, innovation and infrastructure). Here are a few examples:

- VFlow – this Singapore-based company is disrupting the stationary energy storage space with their innovative, reliable, long-duration energy storage system (ESS). The VFlow ESS offers potential advantages in terms of reduced carbon emissions over lithium-ion batteries and has about 78% lower carbon footprint per megawatt-hour of ESS deployed. Its lower cost of ownership and ease of deployment is driving interest from several renewable energy producers around the region.

- ecoSPIRITS – the world’s first low-carbon, low-waste spirits distribution technology out of Singapore. Aiming to end single-use glass, ecoSPIRITS created an innovative circular packaging hardware and technology for premium spirits. The hardware involves smart, reusable vessels, while the company’s network of refilling and washing facilities has a small carbon footprint. On average, ecoSPIRITS eliminates 70-90% of the carbon emissions associated with the packaging and distribution of premium spirits. The company has now expanded to 16 countries.

- eFishery – an Indonesian company that started out by providing an automated feeder with built-in sensors that determines fish or shrimp appetite and adjusts the timing and amount of feed dispensed. The feeder can double the profit per fish pond from about US$2,000/year to US$4,000/year, while decreasing water pollution by 30%. Potential impact is huge as there are 30 million fish ponds in Indonesia alone. eFishery has now transformed into a digital fishing cooperative that works with 15,000 fish farmers across 60,000 ponds selling feed, providing working capital loans, and selling the fish farmers’ produce to wholesalers and retailers.

- TablePointer – an end-to-end AI stack that enables decentralized commercial facilities to optimize energy efficiency, monitor operations, and manage assets. TablePointer’s technology can be easily deployed for multi-location businesses, especially the food & beverage industry, and unlocks as much as 29% energy savings and sustainability gains. The risks from Covid-19, volatile energy prices, and climate change are significant challenges for TablePointer’s customers, and the Singapore-based startup is now supporting more than 100 locations in the city-state, with plans to expand into more cities across Southeast Asia.

We saw contributions to other Goals, of course, but our portfolio startups that didn’t make the cut (the remaining 30%) were typically those we felt would perhaps just encourage more consumerism. We don’t know if we will ever get to a 100% sustainable portfolio, but we anticipate the percentage to increase over time.

Making a pledge

Our latest experiment is to start a movement we’re calling The Sustainability Pledge. In the last few years, there’s been a growing trend called ESG (Environment, Social, and Governance) in the corporate industry, where companies report concretely on their impact in these areas to help investors better decipher financial risk. We acknowledge that like any other standard (e.g. ISO), ESG can be abused and turned into a mere reporting exercise rather than a real effort to improve.

As early stage investors, we don’t think it makes sense to burden our startups with fancy ESG reporting. While we believe measuring progress is important, these fledgling companies are still trying to figure their business out. Instead, we encourage them to do something that is more stage-appropriate. We feel that beginning with awareness and intentionality is enough.

We’ve partnered with RIMM, a sustainability management platform, to begin conducting sustainability workshops for our portfolio companies. In these workshops, we would provide startups a foundational understanding of why sustainability matters—no matter what stage they’re at—and split the participants into small groups to discuss the steps they could take that are meaningful for them as an organization.

At the end of the workshop, we would invite each participant to make their own sustainability pledge. Here’s the most basic version that we’ve adopted:

“We pledge to improve our sustainability performance, to operate responsibly, and to be accountable for our wider environmental and social impact, with the hope of creating a better future for generations to come.”

17 of our startups attended our first sustainability workshop, and a couple were ready to make the pledge right after the session. The rest are still thinking about theirs, but we hope to see as many of our portfolio companies signify their commitment as soon as possible. We aim to run one workshop per quarter where everyone from Southeast Asia’s tech community is welcome to join (free of charge!).

To be clear, we aren’t forcing our startups to do anything that they feel would hinder their chances for success. We simply want to promote awareness so they can figure out what they want to do at which stage of their development. Our hope is that if they go on to achieve the lofty business objectives they set for themselves, that they are also able to make a commensurate contribution to achievement of at least one of the Global Goals.

Keep walking

We’re glad that we’ve taken these steps. By no means are we mistaking our early progress for success. We know we still have a long way to go. But what matters is that we keep walking. Walking with others makes the journey more meaningful.

We don’t quite know how to measure the value/impact of what we’ve done so far. But our gut says that something useful will eventually come out of this.

In the past, technology was a specialized business. Today, every business needs to be a technology business if it wants to stay competitive. In the same way, today a sustainability-focused business can be seen as a specialized business. We believe that in the not so distant future, every business needs to be sustainability-focused if it wants to stay competitive.

If you want to chat more about what we’re up to or have any ideas you’d like to share, just let us know. More people working toward the achievement of the Global Goals can only be a good thing.

We do have one more initiative we’re working on that we’re quite excited about. Can’t wait to share it with the community. Do watch this space.

About Wavemaker Partners

Wavemaker Partners is Southeast Asia’s go-to VC firm investing in enterprise and deep tech startups. Since 2012, it has backed 140+ companies, of which 120+ (85%) are in enterprise and deep tech. The firm has US$180 million in AUM across three funds, and has seen 10 exits valued at close to US$700 million. Recent exits include TradeGecko’s acquisition by Intuit, and Moka’s and Coins.ph’s acquisitions by Gojek. Today, 70% of Wavemaker’s active portfolio startups are aligned with at least one UNDP Sustainable Development Goal. Portfolio startups include Borneo, ecoSPIRITS, eFishery, Growsari, GudangAda, and Silent Eight.

About RIMM

RIMM is a sustainability management platform designed to power sustainable performance. Driven by best-in-class AI and data science, it empowers companies, including leading SMEs and financial institutions in the world, with intelligent tools for sustainability management, reporting, and optimization. RIMM’s mission is to simplify and democratize sustainability so no matter where you are on the sustainability journey, RIMM has the tool for you.

(Our friends at RIMM will be happy to meet other VCs who want to educate their portfolios and raise awareness about sustainability. If interested, you may reach them at info@rimm.io)

Lead image credit: kazuend/Unsplash