It’s a story we often hear in emerging markets: people leaving rural areas for cities in search of a better life, only to find themselves in informal settlements with unsafe water, poorly built houses, and uncertain property rights.

The problem isn’t that people don’t want to buy homes; it’s that there aren’t enough affordable ones available.

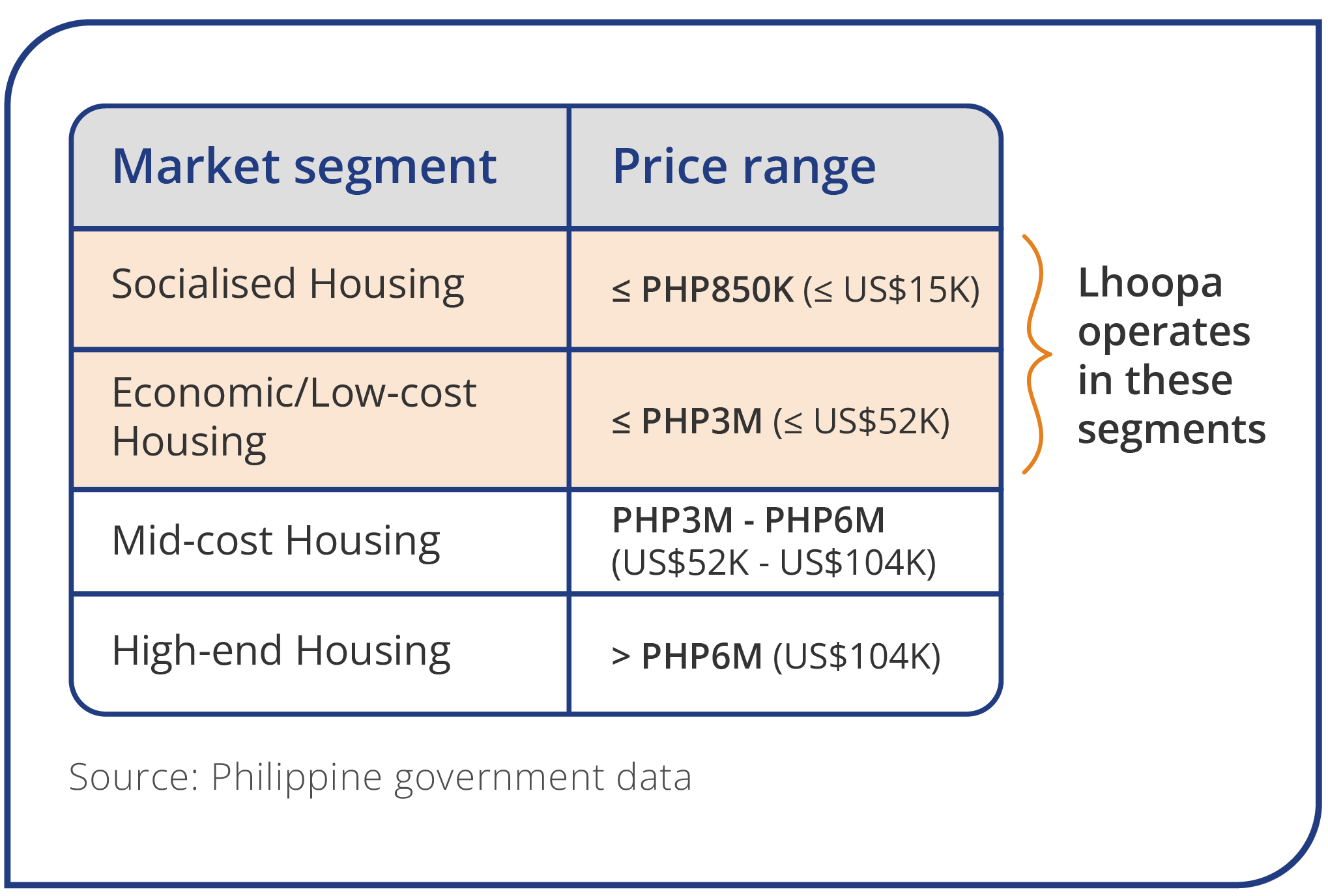

This migration to cities, along with population growth, has created a huge housing backlog. In the Philippines, for example, there was an estimated shortage of more than 6 million homes in 2022, and it’s expected to reach 22 million by 2040, mostly in the lower-cost segment. It doesn’t help that the traditional real estate industry has generally avoided building affordable homes to maximise profits.

This is where Lhoopa Co-founders and husband-and-wife team, Marc-Olivier Caillot (“Marco”) and Sabrina Tan, saw an opportunity.

In the Philippines, subdivision or condominium developers are required to allocate 15% of the total area or cost of the main project to socialised housing. Alternatively, they can pay the equivalent amount as compliance fee to an escrow account. Unfortunately, many developers opt to pay the fee rather than build the homes.

This is because traditional real estate development involves many middlemen, overheads, and other charges, making it almost impossible for affordable housing to be profitable.

Disrupting the old real estate guard

While working as a consultant for a major Filipino real estate firm years ago, Marco saw first-hand the industry’s challenges, particularly the high development cost.

Traditional developers typically buy large plots of land, which can be incredibly pricey in urban areas where land is scarce. They typically adopt a project-centric approach focused on single locations, following a protracted timeline that includes pre-sales, project planning, construction, and post-construction sales. Managing each stage of the process through satellite offices, these developers often employ sales teams that occasionally work with local brokers in the specific areas. Similarly, they rely on large in-house contractors situated in these offices, each managing their own network of sub-contractors, which drives up the costs. This centralised approach also means projects move slower, often leading to delays and cost overruns.

All this eats into the margins, making the unit economics especially for low-priced housing incredibly difficult. To illustrate, a developer would have to sell 67 low-cost houses to make the same profit as selling just one high-end house.

Seeing these inefficiencies motivated Marco and Sabrina to disrupt the real estate scene in the Philippines with their startup, Lhoopa. Founded in 2018, Lhoopa is a proptech platform enabling the large-scale deployment of affordable homes in emerging markets through a decentralised approach. Think of it as Uber for affordable housing.

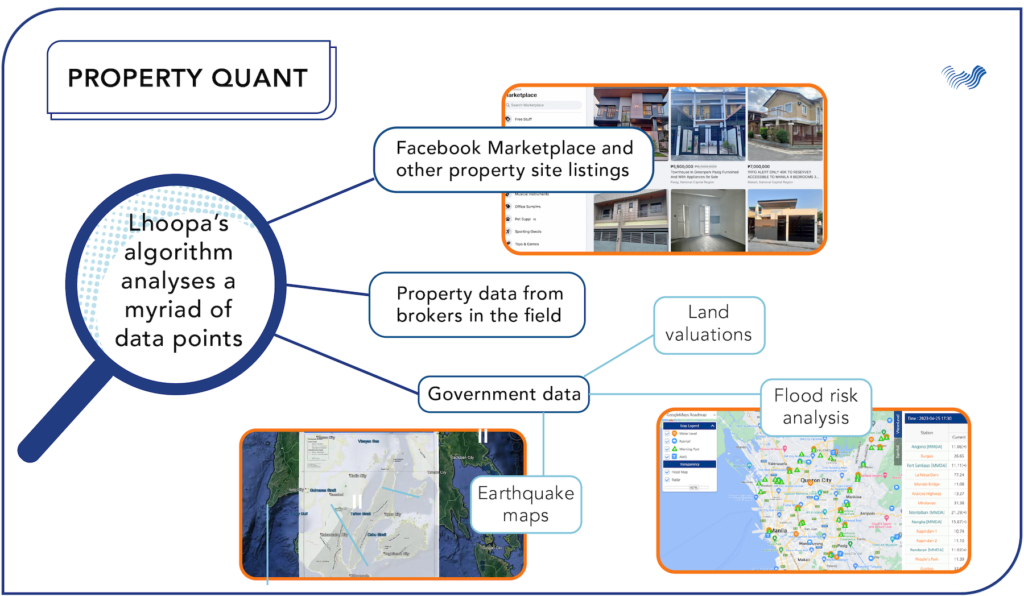

Using data and algorithms, Lhoopa identifies undervalued properties (houses and lots), especially in areas surrounding Metro Manila, the Philippine capital.

However, Lhoopa doesn’t rely on satellite offices and in-house personnel for the development process. Instead, the company works closely with a network of 100+ vetted small contractors and 3,500+ property agents/sellers in the local areas, combining their knowledge and efforts with technology, specifically Lhoopa’s advanced software and suite of apps.

Once Lhoopa’s system identifies an undervalued property, it mobilises partner contractors to assess it, eliminating the need for Lhoopa’s presence. If everything checks out, Lhoopa buys the property, and the contractors renovate or construct the home, and partner brokers sell it and help buyers with the loan process. Lhoopa has dedicated apps for contractors and brokers, who fulfill all tasks and documentation within the apps, completing this entire process in as little as six months.

Traditional firms often price their homes 20% higher than market value to maximise gains, requiring buyers to put down 20% in equity within a two-year pre-selling period. In contrast, Lhoopa prices its homes affordably, leading government financing agencies like PAG-IBIG to offer loans that cover most of the house’s price, reducing buyer equity to as little as 5%. This, along with Lhoopa’s speedy execution, allows buyers to move in quickly, saving them the hassle of renting while waiting for their home to be ready.

For small contractors and sellers, the streamlined home development means steady and quick income. Plus, Lhoopa’s system simplifies the processing of their pay and connects them with potential deals within their neighbourhoods, saving them time and money on commuting.

Some might wonder how Lhoopa ensures the quality of its homes. The company vets partner contractors before onboarding, and then its system tracks and scores their performance and reliability. Lhoopa also employs multi-tiered vetting where financing agencies assess finished projects, and seasoned partner contractors evaluate less experienced ones.

Not just building houses but uplifting lives

Marco’s real estate approach is rooted in his math and investment background. He studied applied math in his home country France and worked as researcher for the European Aeronautic Defence and Space Company before becoming a quant trader on Wall Street. After meeting in the US, he and wife Sabrina moved to the Philippines and started a software and website development agency. While consulting for a real estate firm, Marco decided to invest in his first set of properties.

Coming from a working-class family and being the first in his family to attend high school, Marco knows that buying a home is often the ultimate dream for many families.

Since its launch, Lhoopa has sold more than 2,500 homes to low-income families in around 60 cities, allowing them to own their first homes. Because the homes are affordable and sell quickly, Lhoopa just holds inventory for very short periods. In 2022, the company recorded multi-million dollars in sales, with a 36% return on investment, much higher than the 25% ROI for higher-end housing.

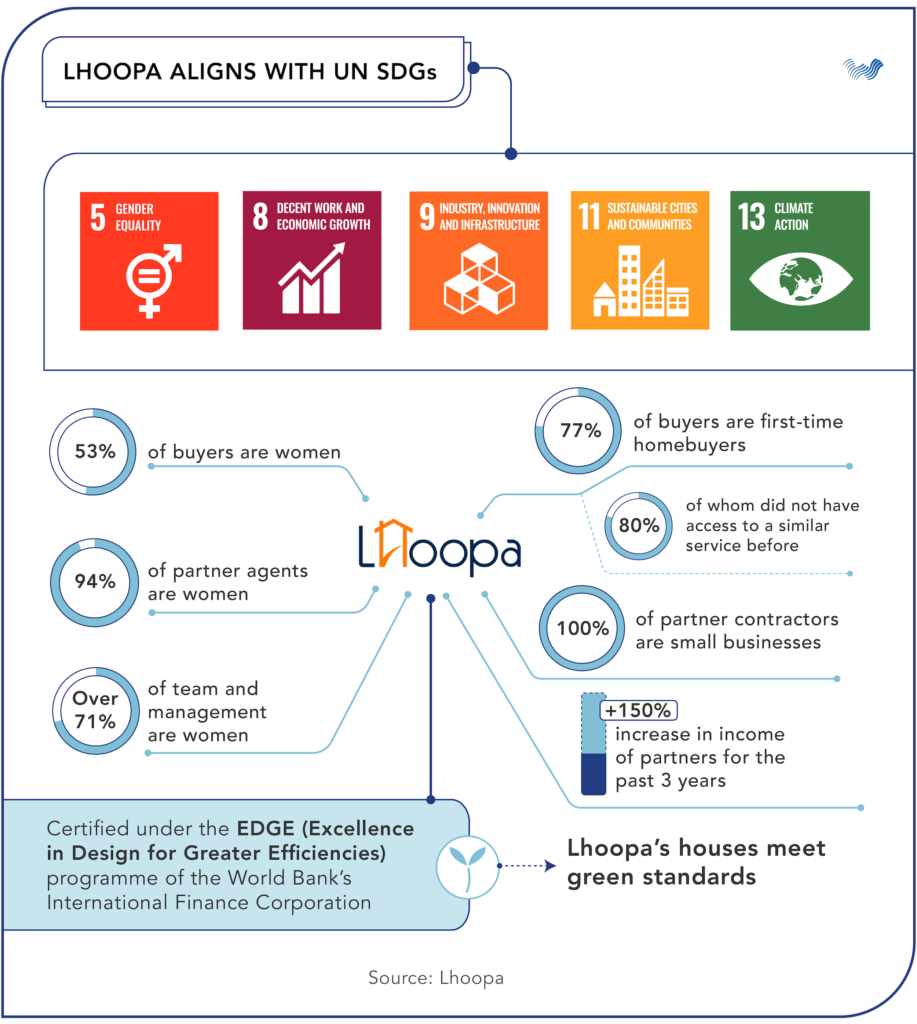

Beyond the numbers, Lhoopa has made a significant impact on people’s lives, as well as contributions to the UN Sustainable Development Goals.

Solving a meaningful problem

Lhoopa is solving a critical issue in Southeast Asia with a defensible solution. Affordable housing is not typically seen as a venture play. There’s a common perception that low-income households lack the capacity to pay. Moreover, housing requires huge capital, which could limit opportunities. However, at Wavemaker Partners, we like to remain curious and explore new possibilities.

Lhoopa initially faced challenges fundraising as many investors were hesitant. But Wavemaker Partners threw its support behind Lhoopa during its Series A round in 2022, recognising the company’s significant potential and impact.

What we saw was Lhoopa’s ability to address a genuine need that existing players have seemingly struggled to solve. The company is using a unique blend of technology and process to orchestrate decentralised operations, which is incredibly difficult to execute. While Lhoopa relies on funding for asset purchases and rapid expansion, unlike many startups, it does not burn through cash. Instead, it is able to sustainably generate cash flow given the unmet demand from a long-underserved market.

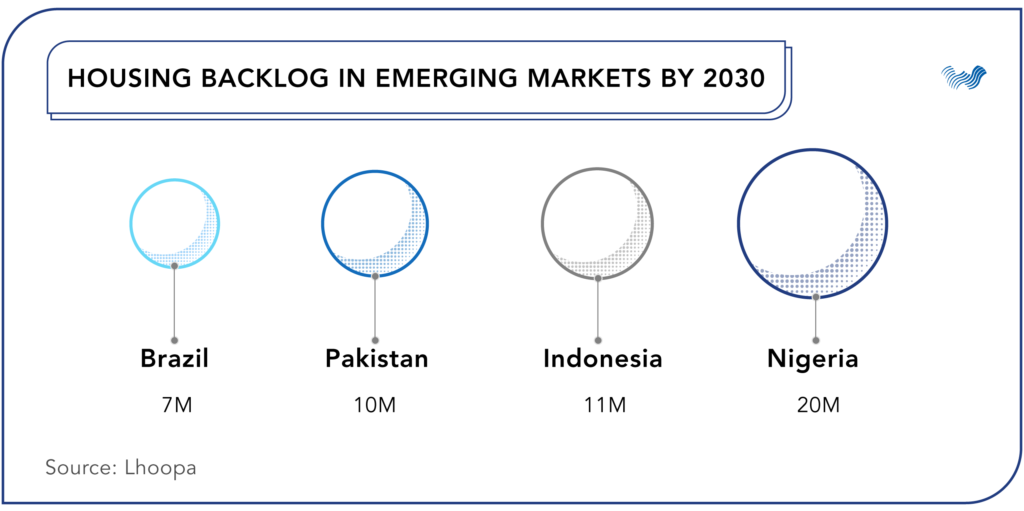

Given its robust traction in the Philippines, Lhoopa has set its sights on tackling the housing backlog in other emerging markets. This presents a massive opportunity, with a potential market size in the billions of dollars.

Beyond the financial aspect, the impact of this expansion will be profound. Lhoopa aims to demonstrate that its innovative approach to an age-old problem can work across emerging markets, one affordable home at a time.

Lead image credit: Sian Labay/Unsplash