During his time at the Singapore Management University, Joel Ang pursued numerous internships in his fields, finance and accountancy. However, his curiosity led him to venture into new territory: venture capital.

He joined Wavemaker Partners as an intern in 2016 and never left.

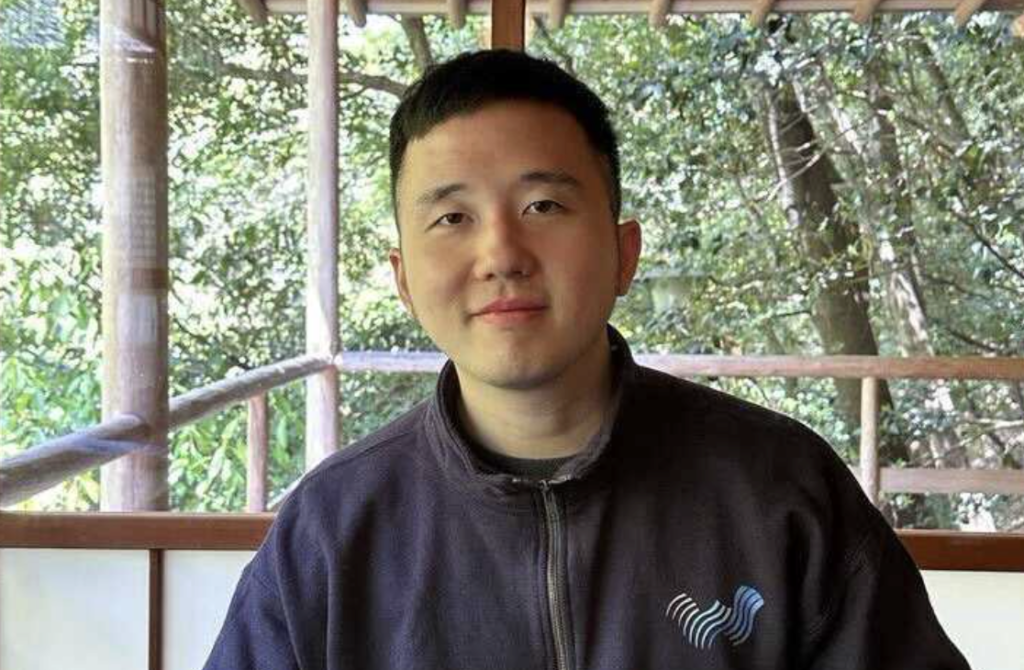

Today, Joel serves as one of Wavemaker’s Investment Principals, co-leading the firm’s 9-member Investment team.

He admits to not fully comprehending the firm’s mission back then. But it didn’t take long for him to get behind the purpose: to back founders solving meaningful problems often overlooked by investors. As Southeast Asia’s leading VC in early-stage B2B, deep tech, and sustainability startups, Wavemaker’s focus meant going against the tide of VCs that often favored B2C ventures prioritising growth above unit economics.

Since its launch in 2012, Wavemaker has invested in more than 190 companies in Southeast Asia–from SaaS and B2B marketplaces to hardware and AI. The firm has raised 4 funds, exceeding US$300 million in total capital commitments, and seen 25 exits valued at US$1.8 billion. That’s a long way from the time Joel joined.

“They were raising Fund II at the time, so a lot of things were in flux. It was as though I was joining a startup investing in other startups,” Joel recalls. Fund II, valued at US$63.5 million–a sizable jump from Fund I (US$6.7 million)–marked the firm’s clear commitment to B2B and deep tech.

Joel wore many hats as an intern, working on various tasks, from helping to refine pitch decks and organising social mixers to marketing. Quickly making an impression on the firm’s leaders, he was offered a full-time role as an Investment Analyst.

While his peers were gunning for investment banking or consulting jobs at prominent companies, he opted to contribute to shaping a smaller firm. With Wavemaker’s evolving structure at the time, Joel helped in creating processes that endure to this day, including standardised investment memos, valuation methods, and audit procedures.

Curiosity seals the deal

Joel vividly remembers the first deal he closed. Founded in 2014, Structo built a 3D printer for dental models that was faster and more affordable than existing printers at the time.

Back then, deep tech companies like Structo faced funding challenges even in advanced markets like Singapore. As Joel recalls, the term ‘deep tech’ might not have even been coined yet.

That’s because comprehending deep tech ventures often demands more time and effort compared to B2C endeavors. Deep techs typically involve complex manufacturing processes and supply chains, coupled with dynamic working capital requirements. It’s akin to cracking a tough nut in order to access the valuable core.

However, Wavemaker’s investment approach revolves around the principle that “Opportunity = Value – Perception.” This implies that the biggest opportunities are those where the actual value surpasses the initial perception.

Structo’s early promise was apparent to Wavemaker. After the firm’s Seed investment in the company, Joel was tasked to conduct due diligence for potential follow-on funding. “I’m not an engineer by any means and should not have been qualified to work on this deal.”

But this was not uncommon for Wavemaker, a vertical-agnostic VC where every investment opportunity serves as a crash course on a new industry. Being highly technical isn’t a necessity, but curiosity is. Joel, fitting this description, excelled in the task by asking pertinent questions, dissecting extensive information, and consistently seeking to understand Structo and its market.

If someone advises you not to invest in a certain type of business because it’s deemed unprofitable, and you take it at face value, you may miss the opportunity of a lifetime. My biggest learning from being in VC is to be curious at all times.

What he discovered was that Structo’s printer was not only faster than others; it also had a recurring revenue model by charging for resin–the “ink” used to create accurate teeth and gum models. With enough scale, the resin had the potential for “software-like” margins. Unlike traditional methods that waste materials, the leftover resin used in Structo’s printer was reusable for the next print. Moreover, the printer required a specific type of resin, making it proprietary.

Currently, Structo’s printers are operational across 5 continents and the company secured US$10 million in new funding last year. While the industry has grown fiercely competitive and other formidable players have emerged, Structo continues to generate strong revenues while being profitable.

Transcelestial was another deal that left a mark on Joel. The company is on a mission to make the internet more accessible by developing small laser-powered devices that communicate like a fiber network. The technology aims to replace costly underground cables and highly regulated radio-frequency devices. As a result, Transcelestial should be able to provide fast speeds without the expense and deployment time required by older technologies.

There’s a lot of excitement around Transcelestial’s solution today as evidenced by its recent US$10 million round. During its Wavemaker-led Seed round in 2017, however, the tech was unheard of. “Working at Wavemaker offers a glimpse into the future as long as you keep an open mind,” says Joel.

“Slow is smooth, and smooth is fast.”

For VCs, growth is a metric you cannot do away with. However, it’s essential to recognise that not all growth is equal. Pursuing growth at all costs without a sensible path to sustainable economics is a risky strategy. This is another important takeaway from Joel’s experience at Wavemaker.

Joel cites Eezee, a portfolio company he’s closely engaged with, as an example. Eezee is a B2B procurement platform that seamlessly integrates into the enterprise resource planning systems of clients. This integration streamlines maintenance, repair, and operations, while facilitating obtaining single quotations for business supplies, eliminating the need to approach multiple suppliers. These expenditures typically demand 80% of the procurement team’s efforts while accounting for only 20% of the total procurement value (consider the Pareto Principle). This underscores the rationale behind partnering with Eezee as a master merchant to capitalise on economies of scale.

While it may be tempting to chase growth, a lack of focus could lead to unrealistic expectations and unfavorable results over time. According to Joel, Eezee has taken a thoughtful and deliberate approach, investing time to observe, reflect, and garner insights.

Rather than spreading itself thin across multiple industries, Eezee committed to understanding every customer’s unique needs. Despite the complexity and intense competition within the procurement industry, Eezee effectively retained clients and achieved healthy growth, securing double-digit margins at an early stage.

The two sides of the empathy coin

Apart from curiosity, for Joel, empathy is equally crucial in venture capital.

Joel experienced a personal lesson on empathy when his dad’s electronics business suffered during the global financial crisis in 2008. Despite being a bit of a rebel growing up, the situation marked a turning point. “I felt helpless and unable to improve the situation. The least I could do was not add to my family’s worries. I decided to take my studies more seriously.”

He gained a greater appreciation for the challenges entrepreneurs encounter. As a VC, he admits to losing sleep particularly during the onset of COVID in 2020, when certain companies faced depleting runways. He had to do his best to assist, whether by revising business plans or actively facilitating additional investment from other investors.

“Mainstream media often portrays finance professionals as emotionless mercenaries. That couldn’t be further from the truth. While our priority is to ensure returns for our limited partners and viable paths to commercialisation, we also strive to empathise with founders, particularly during difficult times. It’s a delicate balance between being logical and sensitive,” Joel explains.

But empathy and personal connections can be a double-edged sword for someone in Joel’s position. He shares: “When things are going well, you share the joy with the founders. But I also have to deliver bad news, like when we can’t invest or provide follow-on financing because of a lack of conviction or capital limitations. We need to make sensible decisions as we invest other people’s money. Yet there’s no straightforward way to have these tough conversations. I’ve been doing it for 7 years, and it never gets easier.”

Nevertheless, that is the job—threading the fine line between parallel priorities. On one hand, Wavemaker must generate attractive returns for its limited partners. On the other, its specialty is in backing B2B, deep tech, and sustainability startups that may have a longer road to commercialisation, but can fill some of the most pressing gaps in the region. “We hope to be the ones helping these companies get there.”

From individual contributor to team leader

Joel’s role at Wavemaker has evolved significantly over time. Initially, he was a jack-of-all-trades, constantly tackling urgent tasks and putting out fires. As the fund expanded and hired more specialised roles, his focus shifted to core responsibilities: investing and enhancing the firm’s ability to identify and assess deal opportunities.

Now a Principal, his scope includes guiding and developing a team of aspiring VCs. Being a leader entails a balance; ensuring the team’s growth while aligning their interests with the firm. Working with smart and quick learners means finding ways to keep them motivated and engaged while providing constructive feedback.

Asked about his biggest challenge today, Joel highlights the importance of both his and the team’s success. “In a growing firm, everyone’s achievements matter. We all benefit when the firm does well.”

Every day, Joel carves out time in his busy schedule for his team to address any urgent issues outside of their regular meetings. This helps to remove any obstacles, bring clarity, and maintain focus on priorities.

Now in its 11th year, Wavemaker is raising its Fund 5. Joel has evolved alongside the firm, contributing to building and supporting a huge portion of the portfolio. Yet the learning never stops. He looks forward to continuing backing founders in their vision and creating value together.

“I might not personally build a tech product, but even if I’m not the one executing an idea, hopefully, I can be the one supporting and helping it come true.”

With additional reporting from Jill Tan Radovan