The alternative protein industry has been the darling of venture capital investors until recently. Plant-based meat, the industry’s main driver that has attracted the most capital, is now seeing a slowdown in sales and waning investments as it falls short of its early promises. Products on the market remain uncompelling for the masses in terms of taste, nutrition, and variety, with plant-based companies struggling to prove that they have displaced conventional meat in shoppers’ carts. Despite having scaled to an US$8-billion industry (according to a 2021 GFI report), it has yet to make an obvious dent in curbing the carbon emissions and unsustainable practices of industrial farming.

Many investors now turn their interest towards deeper technologies, including cultivated meat and fermentation, which had previously received much less attention. Still, with the glaring cost and scalability challenges, independent critics have alluded to the alternative protein industry as a fad over the years. Without a clear path to success–how will this space regain its sizzle?

Polarising protein

The alternative dairy segment has by far seen the most success with consumers across a myriad of diets, attaining the highest volume growth in the past year, fueled mainly by the growing popularity of oat milk.

What are some push factors driving consumer uptake? Experts estimate that 68% of the adult human population globally has some form of lactose intolerance. The pull factors? While this remains harder to pinpoint, it helps that oat milk is an easy switch-out for regular dairy in coffee and, as many argue, a better complement than other plant-based dairy options. But mostly, it is made up of what it is–oat milk. The saying goes, “you are what you eat,” so a long list of complex ingredients probably would not appeal to the health-conscious consumer.

The success of alternative dairy remains an anomaly for now. As plant-based companies scale and become more mass-market, they have to overcome the ingrained omnivorous programming of the average consumer. Their moment in the sun, driven by early adoption from vegans and vegetarians who had never been this spoiled for choice, has passed. They now face the pragmatic majority, who never had a problem with eating meat, or the fickle ‘flexitarians,’ a growing segment they might be able to convince if their products were up to par.

The fallout of plant-based meat thus seems like a consequence of underestimating how challenging it is to cross the chasm. The thesis for plant-based alternatives relies on drastically changing consumer behavior and eating patterns. While the hope remains for technology to advance to a point where we can’t tell real meat apart from its plant-based sister, that is not the case today.

The industry’s tapering growth now begs the question of whether its commercialization has been immature. And if that is the case, are VCs partly responsible for today’s outcome?

Cultivated meat takes a long while to cook

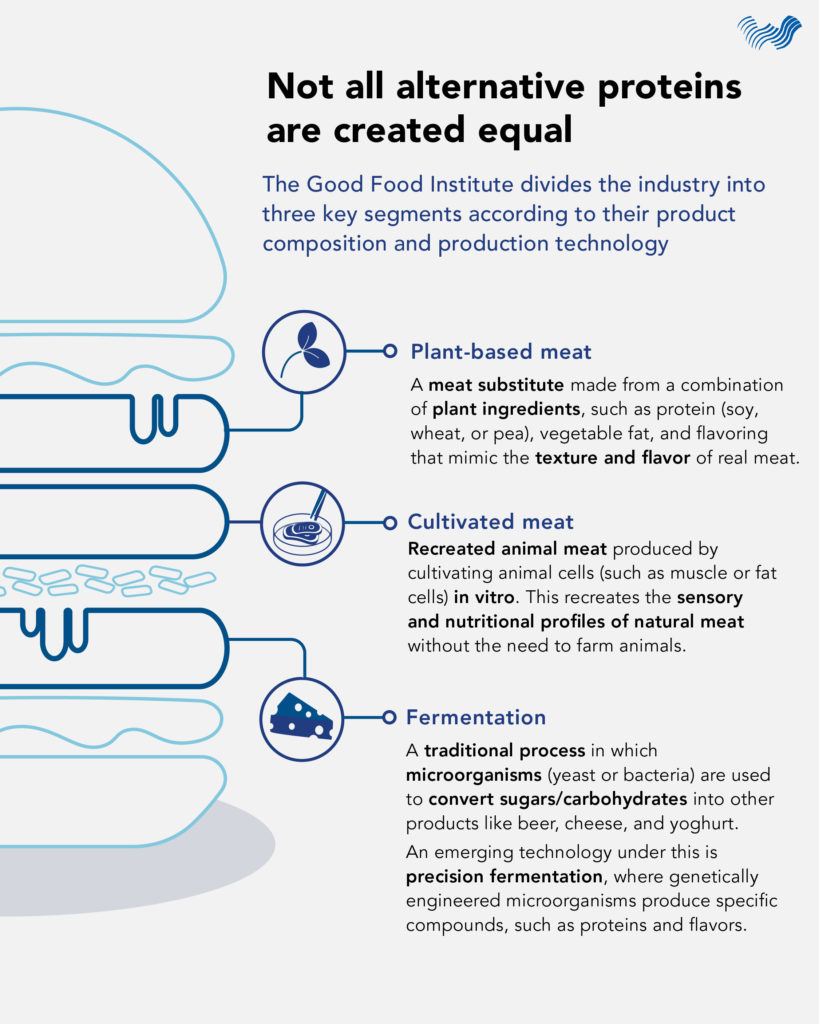

Not all emerging alternatives are equal. Plant-based opportunities are a relatively low-hanging fruit for VCs, so unsurprisingly this segment has received the majority of VC funding to date. Good Food Institute (GFI) divides the industry into 3 key segments according to their product composition and production technology: plant-based, cultivated, and fermentation.

The allure of cultivated meat lies in its potential to bear a stronger likeness to real meat than the other alternatives, which makes sense given how it is fundamentally cultivated from the same animal cells. After Wavemaker Partners’ first investment in a cultivated meat company in 2022, I was fortunate enough to have tasted a cultivated duck and chicken prototype. I must say I was pleasantly confused–the similarity was impressive for an early attempt, and the experience cleared most of my initial doubts that meat could be recreated from its building blocks. Witnessing the boundaries of innovation being pushed first-hand, it is fascinating how this could completely reinvent how food is produced.

Meanwhile, new emerging technology like precision fermentation is not only showing early promise to be more efficient and cost-effective, but it can help to produce specific, novel functional ingredients that can supplement and improve the sensory experience and nutritional aspects that are lacking in plant-based or cultivated products, and can even recreate other traditional food groups.

However, given that cultivated technologies are more niche, B2B, and upstream in production (it’s true to a certain extent for fermentation), they have much longer research and development, regulatory, and commercialization horizons compared to plant-based. Admittedly, this does not quite fit the mold of the typical VC investor looking to exit within an average of 6 years, just yet.

According to GFI’s 2021 statistics, excluding the food conglomerates with plant-based ranges, well over 780 companies are primarily engaged in developing plant-based products worldwide. Meanwhile, only 88 fermentation and 110 cultivated product companies were identified. Not only has the funding preference created this stark difference, it also continues to foster increasing fragmentation across many new emerging players.

Undoubtedly, the road to scale up remains challenging across the industry, evidenced by the fact that most cultivated meat companies have repeatedly missed their product launch deadlines. For one, while a strong team of biologists may be able to recreate products at the lab-scale, it takes a village to address the enormous engineering challenge of industrializing the process. Large bioreactors, which emulate the biological environment for cells or microorganisms to grow in, are highly expensive and have conventionally been used at much smaller scales for Big Pharma applications. So, while achieving an impressive likeness to meat is a fantastic breakthrough, we will need another quantum leap to bring costs down to produce affordable, abundant products without compromising quality. Until then, mass-market success remains a big ‘if.’

Nevertheless, at Wavemaker, we believe the race to scale, to reach price parity, and for market share shouldn’t come at the expense of product and technological readiness. Across our deep tech companies, many of which we were able to make early entries in, founders have been unafraid to tell us when their technology is not ready for launch, despite pressure from investors to deliver traction. We have learnt that this is a delicate and challenging balance to maintain, and it serves as a test of our patience and trust in our founders.

So, while we wait for technology to catch up to where it needs to be, what are some other opportunities here in Southeast Asia?

Not in a rush to eat

More use cases will likely emerge in the coming years, as we see the various alt protein technologies evolve and mature further. We expect to see growing partnerships and cross-learning opportunities as these applications become more complementary, with strong potential to plug one another’s shortcomings.

We’ve also seen encouraging regulatory support for deeper technologies. Singapore became the first country to fully approve cultivated meat in 2020, and more recently in October 2022, green-lit a new protein produced via fermentation bioprocess where microbes are fed with gases, including carbon dioxide, oxygen, hydrogen, and nutrients. Both of these come ahead of the US market’s approval for cultivated seafood and partial approval of cultivated meat with FDA’s announcement just late last year (cultivated meat is still pending clearance by the US Department of Agriculture). This highlights Singapore’s domestic market capabilities and drive for innovation.

In fact, this is best exemplified by the ‘30 by 30’ initiative–an overall strategic focus on climate and food security that has created a sandbox for food innovation where companies have access to a myriad of resources across research, industry, and funding support. This direction and support leverage Singapore’s position as a growing biotechnology and advanced manufacturing hub, and play a meaningful role in allaying concerns around potential challenges and the timing to scale. This subsequently also gives emerging players the platform they need to tackle the lack of product localization that we’ve seen from most western players.

Granted, founders with such ‘wave-making’ potential do not come by easily. The talent pool in these rigorous academic and research fields is tiny, especially when narrowed down further to those with coveted commercial abilities. But at the end of the day, that is the job–to identify, nurture, and support the best founders out there in creating the most game-changing technologies while building viable businesses out of them.

We are still in the early days of reinventing food and reforming production systems. As with anything novel, there will always be a degree of doubt that’s cast on the viability and safety of things. At Wavemaker, our eyes stay peeled for solutions that are 10x better than the status quo. The fact is that our entire global food system, including traditional agricultural and production methods, is unsustainable. This presents a meaningful and sizable opportunity for founders to transform it scalably and defensibly. If you’re a founder working on cultivated or fermentation technologies, please reach out. We’d love to chat!

Edited by Jum Balea

Lead image by Peter Dawn/Unsplash