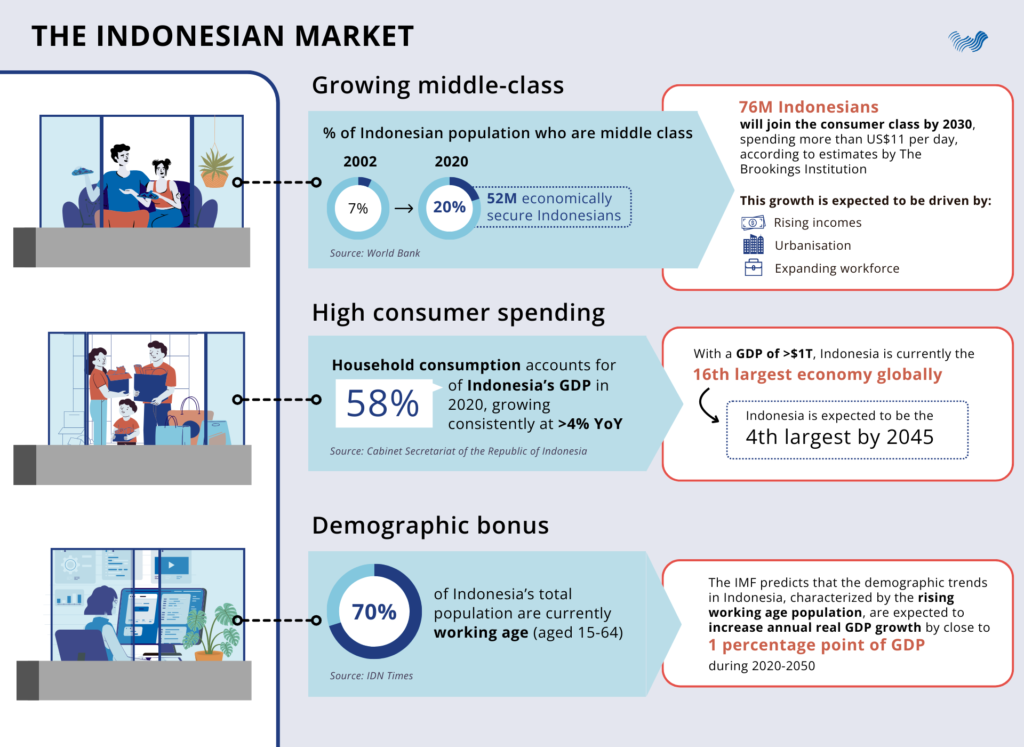

Almost all of Indonesia’s unicorns and decacorns are B2C companies, except perhaps two. But that’s not surprising at all. Indonesia is a goldmine of a consumer market—it boasts a staggering population of 270 million people, making it the largest in Southeast Asia and the fourth-largest in the entire world. The country is also becoming more and more tech-savvy. With a growing middle class, increased private consumption, and some seriously advantageous demographics, Indonesia has skyrocketed to the top of Southeast Asia’s startup scene over the years.

While Wavemaker Partners has traditionally focused on B2B, Deep Tech, and Sustainability investments, we’ve recently been receiving inquiries about our consumer deals, particularly in Indonesia. In our Fund 4, we’ve invested in five Indonesian companies, two of which are B2B (Pitik and Verihubs), one is purely B2C (Fit Hub), and two are both B2B and B2C (Soul Parking and Sirka).

Historically, we’ve adopted an opportunistic approach to B2C investments, with around 15% of our 200+ deals since 2012 being purely B2C. However, we believe that some of the investment characteristics we like in B2B businesses can also be found in B2C deals. Let me take you through some of them.

1. Solving real problems

The B2C strategy typically encourages consumer engagement, often relying on continuous household spending to sustain their business. But at a time when people are dealing with rising mortgage/rent costs and a decrease in the value of money, it may be a lot to demand. If you’re a startup and the product or service you offer is something people can easily let go of, it may mean that you’re not addressing a compelling problem or pain point.

On the other hand, we appreciate the approach of B2B startups that have seen lower churn despite tough times because they’re solving genuine problems for their business customers. Having said that, it excites us when a B2C company tackles a solid challenge rather than simply encouraging more consumption.

Let’s look at motorcycle parking in Indonesia. In recent years, Indonesia has seen a rapid increase in the number of vehicles, with the country having the largest motorcycle population in the world after India. However, according to the Indonesia Parking Association, there is motorbike parking discrimination in malls and office areas across Jakarta, where parking spaces are limited and far from buildings. As a result, Jakarta has suffered from illegal parking, now one of the major sources of traffic congestion (estimated to contribute at least 30%), with Jakarta among the top 10 most congested cities in Asia. From 2020 to July 2022, ~57,000 vehicles were officially prosecuted due to illegal parking, which is also estimated to account for billions of Rupiah in revenue loss.

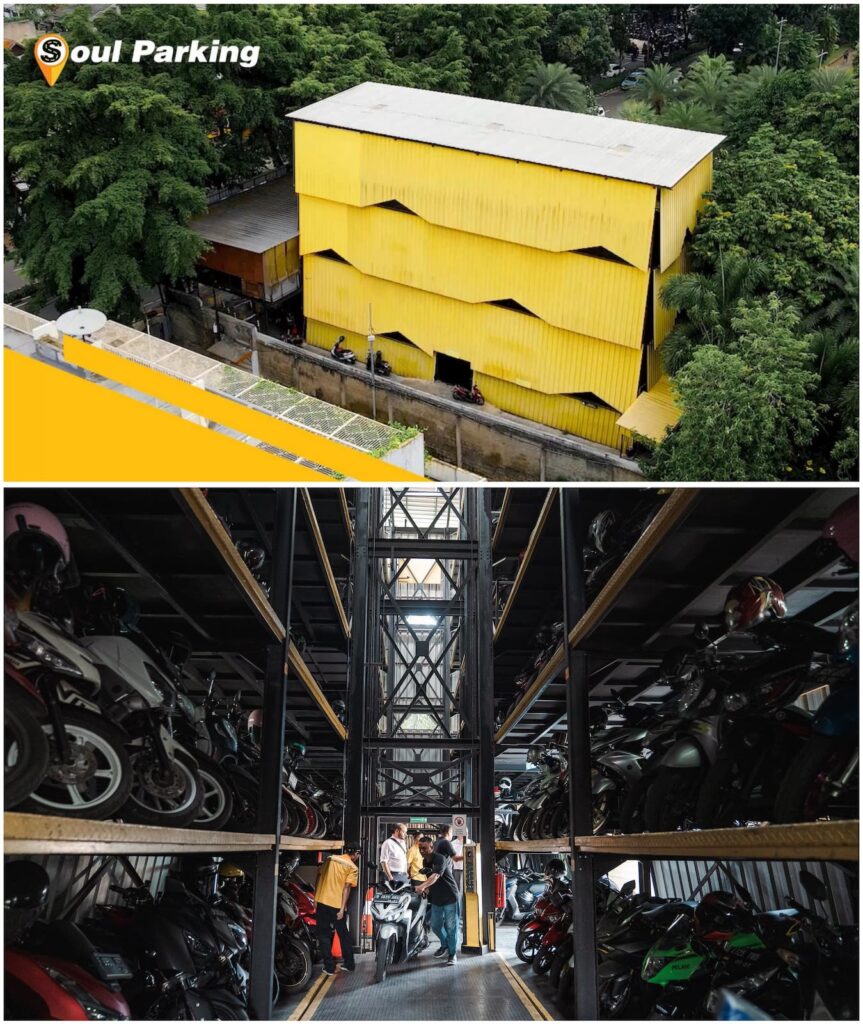

This, for us, is an example of a real-world problem. To solve it, our portfolio company Soul Parking has developed a business model serving both consumers and businesses.

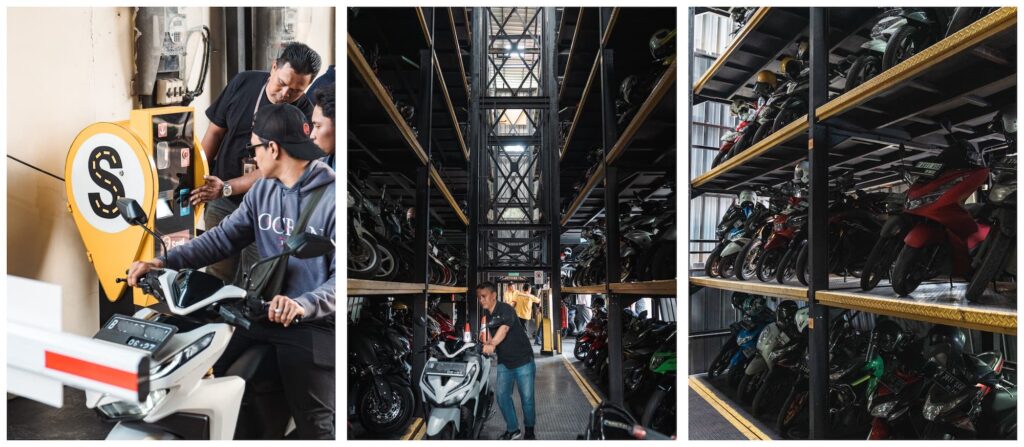

For real estate owners, Soul Parking created an IoT-enabled, compact motorcycle storage solution called the Soul Parking Tower–capable of accommodating up to 240 motorcycles on a small 60-sqm plot of land. This innovative approach makes parking more efficient by utilising vertical space with eight levels upwards.

Additionally, the company developed the Soul Parking Operating System, which includes a dashboard management feature for real-time transaction tracking. This not only fosters reliability but also transparency, tackling issues such as revenue loss and tax leakage.

For motorcycle riders, Soul Parking offers a seamless parking experience, complete with digital payment options. Currently, Soul Parking operates in more than 50 locations across Indonesia, serving more than 1.6 million unique riders.

With the motorcycle population growing faster than parking infrastructure, Soul Parking has recorded a high 95% occupancy rate across its locations, growing its revenue by more than 2x from Q4 2022 to Q4 2023.

2. Stickiness

B2B startups often face longer cycles but generally enjoy good retention rates and contribution margins, which can lead to attractive customer lifetime value. What’s more, these companies tend to be more resilient and less influenced by market cycles, especially when they address critical business needs. They have the opportunity to foster deeper relationships with their clients, leading to increased loyalty and advocacy. This becomes especially crucial in industries like healthcare and financial services, where customers seek long-term partnerships with their suppliers.

On the other hand, B2C startups may struggle with shifting consumer trends or the need to keep customers engaged through subsidies. Nevertheless, Wavemaker is always intrigued by consumer-focused startups that manage to build a sticky user base without burning through excessive cash.

Let’s look at the journey of another portfolio company, Sirka, which offers a subscription to certified nutritionists on their platform. While the business has managed to scale considerably focusing on B2C, they realised that they could also provide value to doctors (B2B) by helping to ensure that their patients adhere to taking the prescribed medicines regularly and living a healthier lifestyle. At the same time, the doctors could gain access to patient data on the app, allowing them to give more precise treatments.

Sirka decided to shift their focus to acquiring customers through doctors rather than directly targeting consumers. This approach, leveraging clinics as credible endorsers and doctors as prescribers, has led to a stronger sense of trust and perceived value among customers. As a result, the business has seen high single-digit improvement in margins, along with higher patient retention and adherence rates.

3. Capital efficiency

We’re also big fans of capital efficiency, and we’ve observed that B2B companies tend to do well in this regard. To illustrate this concept, we often use the raindrops and buckets metaphor within our firm. Raindrops symbolise contribution margins, while buckets represent overhead costs. Unfortunately, many B2C companies we encounter have small raindrops but large buckets they struggle to fill, resulting in significant losses. On the other hand, B2B companies typically have good-sized raindrops and manageable buckets, leading to clearer paths to profit.

Of course, there are always exceptions. We’re particularly keen about consumer-focused startups that adhere to the principle of having large raindrops and small buckets. We can say that all three of our recent consumer deals in Indonesia—Soul Parking, Sirka, and Fit Hub—have demonstrated positive contribution margins, with some even achieving positive EBITDA.

Let’s zoom in on Fit Hub, which is building hyperlocal, premium affordable gyms located near residential homes and offices in Indonesia. Fit Hub launched in early 2021 to address the challenge of working out in Indonesia, given worsening pollution and the lack of public parks (Jakarta has one of the worst air pollution globally). While good-quality gyms were costly, affordable neighbourhood gyms were often of very poor quality. Hence, Fit Hub aims to democratise access to gyms for the mass market by offering affordability without compromising on quality.

Through operational excellence, Fit Hub has consistently recorded double-digit EBITDA margins across their outlets and a high single-digit EBITDA margin at the group level–while maintaining a negative working capital cycle. This basically means the company is able to generate cash for its day-to-day operations without heavily relying on borrowed funds. An example of how Fit Hub optimises their operations is by employing just three managers across three branches, as opposed to the standard five managers per branch for a typical mega gym in Jakarta. Additionally, the company strategically places its gyms in shophouses where the rental fees are much cheaper compared to malls.

At Wavemaker, we value optionality. Businesses that can deliver capital-efficient growth reduce their reliance on large funding rounds. While we understand the importance of striking a balance between growth and profitability, we appreciate startups that have the option to grow faster using either their own free cash flow or raised funds (equity and/or debt).

Seizing opportunities when money is no longer free

In the past decade, we’ve witnessed significant investment pouring into the Indonesian market, driving valuations to heights as everyone clamoured for a piece of the pie. There seemed to be little need for careful consideration or taking technological risks. The prevailing assumption appeared to be that there was no need to reinvent the wheel. The country’s glowing macro statistics and the belief that if B2C models thrived in China and India, they’d do the same in Southeast Asia, were enough to give investors conviction.

However at Wavemaker, we abide by a core tenet: “Opportunity = Value – Perception”. In simple terms, the best opportunities come when a company’s true value is high but the market doesn’t quite see it yet. Our goal is to invest in undervalued companies that have the potential to create real value through cash-generating businesses, leading to exceptional returns.

This has led us to focus on the B2B, Deep Tech, and Sustainability sectors in our 11 years of presence in Southeast Asia. Consequently, this is how we’ve found ourselves somewhat on the sidelines of Indonesia’s B2C scene.

But here’s the intriguing thing: the landscape has taken a turn in the past couple of years, as the funding winter brought Indonesia valuations down to more sensible levels. Investors have taken extra caution in an attempt to separate the wheat from the chaff. For Wavemaker, that meant managing to strike some fascinating B2C deals in Indonesia.

If you’re currently building a consumer startup and resonate with the principles we discussed above, we encourage you to reach out to us. We’re eager to learn from you and potentially partner with you on your journey.

Edited by Jum Balea

Lead image by Adrian Pranata/Unsplash