Many of Vietnam’s street corners sport surreptitious advertisements for “quick loans without collaterals” and “instant financial help”.

The providers of these fast funds are notorious both for their painful interest fees—many charge interest dozens of times higher than the state-set legal limit—and their unscrupulous methods of getting their money back.

Nam Long Financial, which is considered one of the largest loan shark groups in Vietnam, charges interest rates from 172 to 205 percent per annum. In cases of especially high need, their rates may jump up past 1000 percent.

But tales of cut fingers, lost homes, and torture do little to dissuade desperate families who need the money to pay hospital fees, continue their education, or keep their business afloat.

69 percent of the Vietnamese are unbanked or experience a lack of access to formal banking services, leaving many with seemingly no choice but to turn to loan sharks.

It’s an issue that local startup Canal Circle is hoping to solve.

Bespoke tech solutions for MFIs (microfinance institutions)

Even before graduating from MIT, Evelyn Ha Nguyen held high hopes of one day returning to Vietnam and making a major impact in small communities.

She’d always been fascinated with tech-enabled financial services, and for about one year after getting her degree, she traveled throughout rural areas in the country to learn more about the day-to-day financial difficulties of rural Vietnamese.

Microfinance drew Evelyn’s attention as a possible solution to their woes. These services, which include microcredit, small loans, microinsurance, and more, have become an important component of the country’s financial system.

In fact, according to the deputy governor of the State Bank of Vietnam (SBV) Nguyễn Kim Anh, they are “some of the most effective tools for poverty alleviation.”

Evelyn co-founded Canal Circle in January 2019 alongside Surat Teerapittayanon, another MIT alumni and deep neural network expert with a PhD from Harvard, and Thy Thang (Tang), an industry veteran with a successful financial services business of his own.

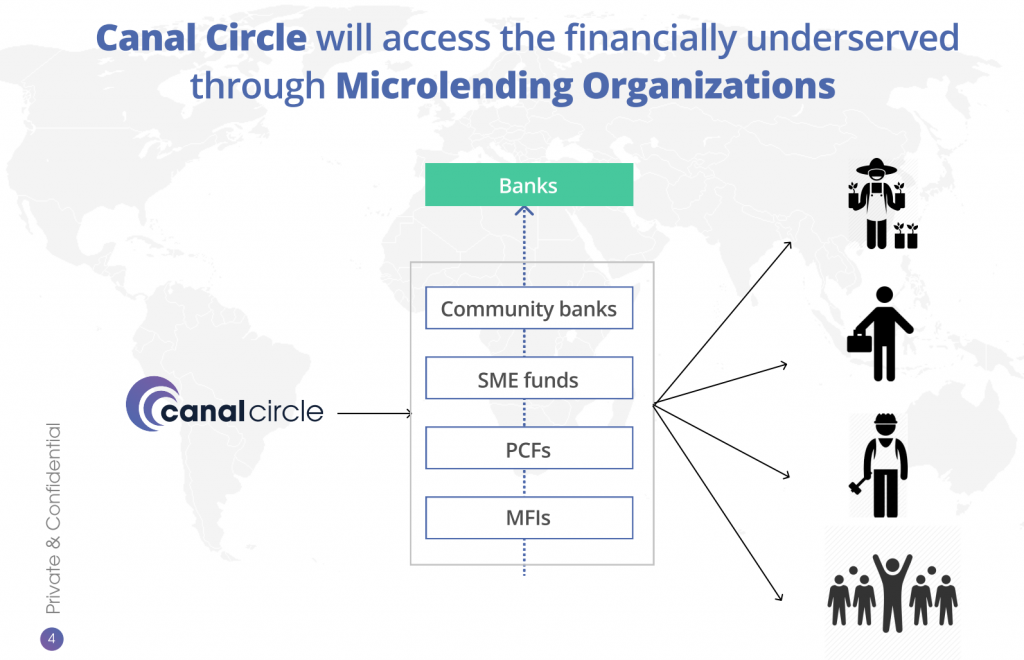

The platform develops bespoke tech solutions for financial actors in Vietnam’s ecosystem to help them operate at scale.

MFIs need help to scale and consolidate their operations

A lack of technical support and qualified staff plague many microfinance institutions in Vietnam. It can become difficult to manage growing client lists and follow up on payments. This bottleneck in operations prevents MFIs from scaling, which in turn blocks families from getting the financial help they need.

As Wavemaker Partners learned more about Canal Circle’s vision, they saw how the company’s plan to transform Vietnam from the bottom-up was supported by a strong team of engineers, dedicated and experienced founders, and a deep awareness of the people they were serving.

The company’s unique insights about market demand are gleaned from almost-daily visits to end-users around Vietnam.

“We’re meeting with them face-to-face and learning about how they would benefit from better microfinance,” explains Derrick Nguyen, Marketing Analyst at Canal Circle.

“We are very close to the market because of how often we meet and interact with those who need our services. From our leadership to our tech and finance teams, everyone here cares deeply about what we’re doing.”

Canal Circle’s bespoke technology solutions for financial institutions and brand partners make MFI processes faster, more transparent, and more efficient.

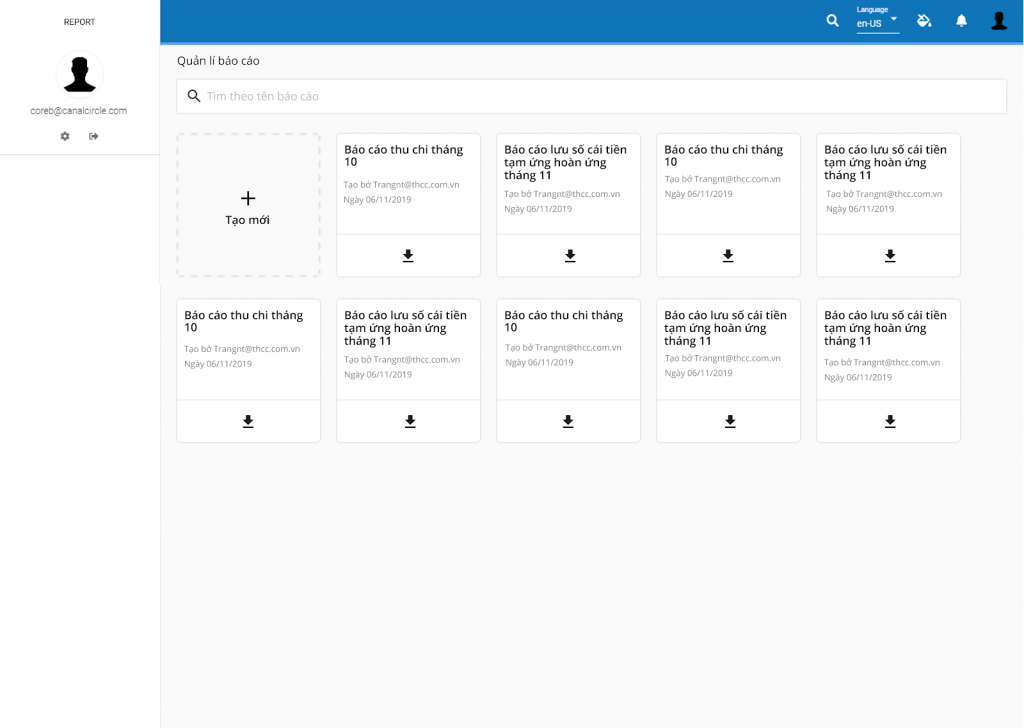

So far, they have developed two main services—Core-B, a management portal, and Mini, a collections app.

Both of these applications are built from scratch, served as a package to MFIs, and customized further based on each client’s needs and design specifications.

Their services are designed to help organizations to be proactive in operating, analyzing and exploiting information to manage risks and develop their business.

“We are continually aiming for perfection in payment digitalization, loan disbursement, and recollection,” shares Evelyn. “By digitalizing procedures, MFIs can increase operational efficiency while simplifying their consumers’ processes.”

“MFIs face issues like inefficiency, costly expenses, and outdated work processes,” shares Derrick. “That’s why we’re here: our cutting edge technology and core banking products can help them improve their operations. Our tech, which includes AI and deep machine learning, doesn’t just manage data. It also analyzes the data so that MFIs can identify where they need to improve.

“This way, they become empowered to deliver the best solutions to borrowers.”

Canal Circle provides tech to community banks, SME funds, People’s Credit Funds (PCFs), MFIs, and other financial actors, who in turn serve farmers, families, low-income individuals, and more.

Their mission and tech were so compelling that Nguyen Thi Tuyet Mai, a prominent financial thought leader, quickly gave them her support. “Evelyn and Thi Tuyet Mai share the same passion for uplifting people and their lives,” says Derrick.

Evelyn and Thi Tuyet Mai share the same passion for uplifting people and their lives.

“Canal Circle’s long-term vision—wider financial inclusivity through tech-—and our creative applications of technology to solve problems really won her over.”

A better life for thousands around Vietnam

Within less than half a year of operating, Canal Circle has already built partnerships with two major MFIs, each with tens of thousands of clients. And they’ve already begun to see positive impacts.

Before working with Canal Circle, An Phu MFI was fully reliant on paper and traditional processes. Thanks to Canal Circle’s Core B product suite, they’ve fully digitalized—the MFI’s officers are able to quickly track all outstanding loans and make collections based on transparent, precise data.

“We regularly have loan officers sharing about how much time they’ve saved,” says Derrick. “Not only that—we regularly hear stories from mothers and families who have been able to buy tools and machines for their farms and crops, for example.”

A story from An Phu

On the team’s trip to An Phu before the new year, they got the chance to meet a borrower’s family. With just an initial loan of 6 million VND (about USD260), their life was completely transformed.

Back in the early 2000s, the borrower’s family was recognized as one of the poorest families of An Phu. He worked as a fruit and vegetable wholesaler at the market, with barely enough to make ends meet.

In 2011, he trusted An Phu MFI, one of Canal Circle’s partners, and borrowed USD260, officially turning over a new page in his family’s life. He began raising animals, like chickens.

Over the years, the borrower, his family, and his farm survived animal epidemics, health scares, and constant trials.

By 2016, after five years, his family finally rebuilt his house, paid for his sons’ education fees, and expanded the allocation range of his products.

“Stepping into his house now,” Evelyn writes, “we are awed by the vast grassland with a barn house of chicken, a large herd of goats, the glassy lake at the end of the garden, looking out on the imposing hills of An Phu Province.”

On the walls of the house hangs certificates of prizes his sons had achieved – his elder son is now a senior at the Vietnam-Hungary University, and the younger one is studying in high school.

She shares, “We are touched that we are helping An Phu MFI to get closer to potential customers with inspiring journeys like this.”

What’s in the works

In the future, Canal Circle is planning on launching Tizo, a customer-facing app that will make it easier for individuals to procure high-quality, yet affordable goods and services. “We are very excited about Tizo. It’s a critical component for us to connect with end-users.”

Through Tizo, borrowers will be able to manage their loan and savings balances, as well as their repayment schedules. The app will also hopefully serve as a low-cost communication between MFIs and their clients, with features like automatic loan reminders and automatic balance change notifications.

“After coming home from such memorable trips, Canal Circle Team members are evermore excited to pour our heart into perfecting the system. We are one step closer to improving life in rural parts of Vietnam. Cheers to a good life!”